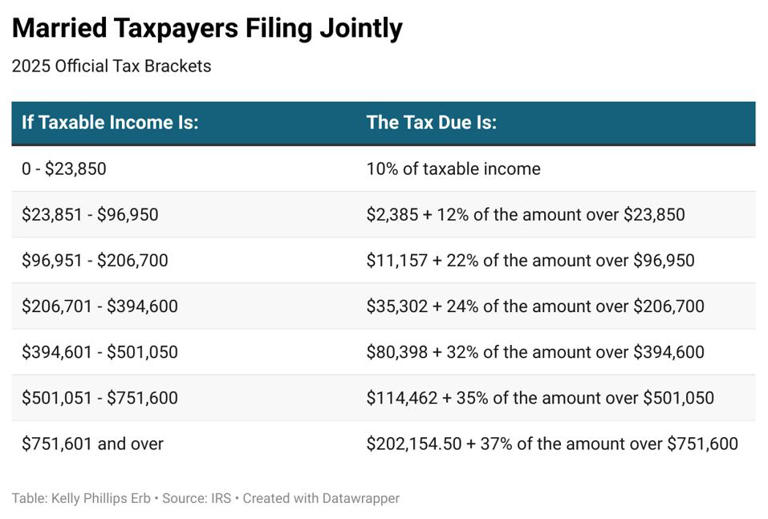

Tax Brackets 2025 Standard Deduction - IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, 10 percent, 12 percent, 22 percent, 24 percent, 32. Tax Brackets 2025 Standard Deduction. Single or married filing separately: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, 10 percent, 12 percent, 22 percent, 24 percent, 32.

Tax Brackets 2025 Standard Deduction Bernadette Simpson, These tax rates are for the 2025 tax year covering tax returns that will be filed in 2026.

Here are the new federal tax brackets for 2025—the standard, California’s tax brackets for 2025 are set at the.

2025 Tax Deductions And Credits Auria Carilyn, Here's a look at the changes unveiled by the irs that will take effect for the 2025 tax year and returns that are filed in 2026.

IRS Announces 2025 Tax Brackets, Standard Deductions And Other, “for single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2025,” the irs tax inflation.

Federal Standard Deduction For Tax Year 2025 Grata Mathilde, Here's a look at the changes unveiled by the irs that will take effect for the 2025 tax year and returns that are filed in 2026.

2025 Tax Calculator Federal Irene Howard, The 2025 standard deduction amounts are as follows:

2025 Tax Brackets And Deductions Victor Coleman, Note that you won’t be able to calculate your tax brackets for.

Understanding the 2025 Tax Bracket and Standard Deductions Lendstart, For heads of households, the standard deduction will be $22,500 for tax year 2025 — up $600 from 2025.

Tax deductions for 2025 tax year. Get expert insights on india’s union budget 2025 expectations, focusing on personal tax for budget 2025, including tds for nris & new income tax rules in india.