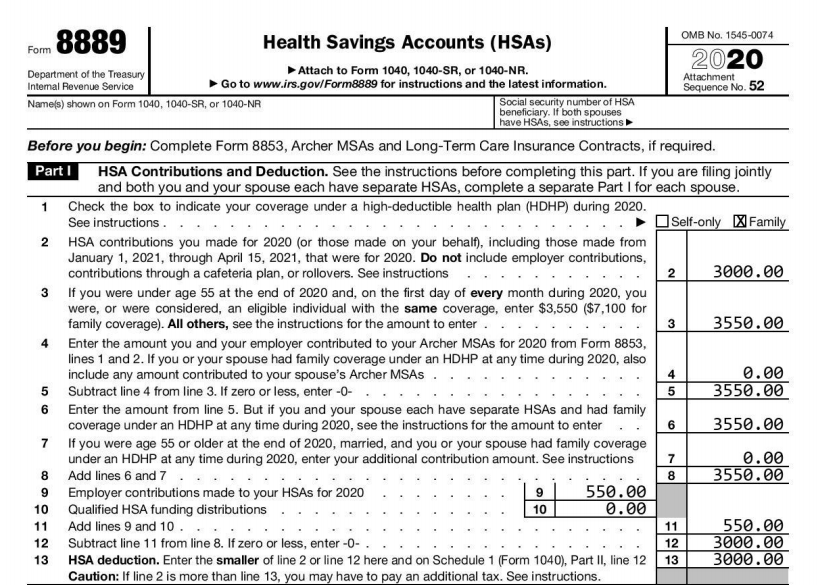

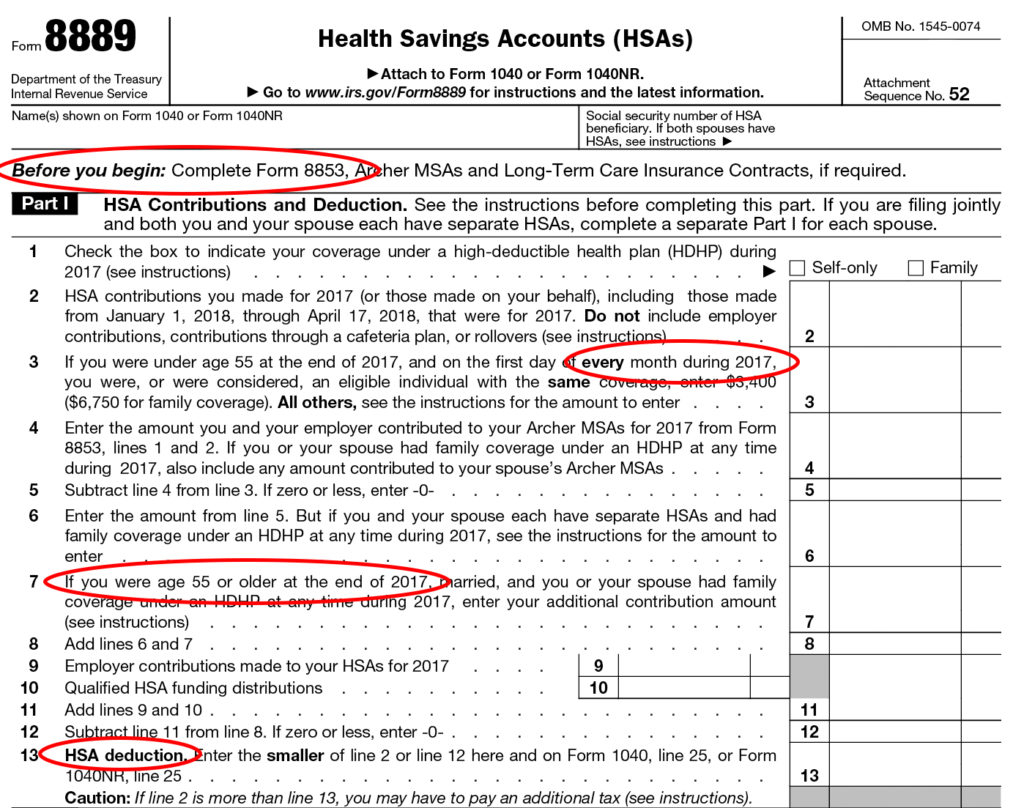

Irs Form 8889 For 2025 - 2025 Form 8889 Editable Online Blank in PDF, Irs form 8889 is used by taxpayers to report contributions to and distributions from health savings accounts (hsas). How to file HSA tax Form 8889, The irs has posted a draft 2023 tax year form 8889, health savings accounts (hsas).

2025 Form 8889 Editable Online Blank in PDF, Irs form 8889 is used by taxpayers to report contributions to and distributions from health savings accounts (hsas).

IRS Form 8889 Instructions A Guide to Health Savings Accounts, The primary purpose of form 8889 is to ensure the proper tax treatment of hsa contributions and distributions.

Put simply, the irs uses form 8889 for hsa reporting. This includes calculating your allowable hsa deduction and determining if any of.

Irs Form 8889 For 2025. Form 8889, health savings accounts (hsas) a taxpayer must complete form 8889 with form 1040 if the taxpayer (or spouse if filing a joint return) had any activity in an hsa. Taxpayers also use form 8889 to figure out any amounts that must be included in their income, determine their hsa.

Form 8889 Instructions Information On The HSA Tax Form, Taxpayers also use form 8889 to figure out any amounts that must be included in their income, determine their hsa.

IRS Form 8889 Instructions A Guide to Health Savings Accounts, You can do so by completing irs form 8889 and attaching it to your form 1040.

Irs Hdhp Minimum Deductible 2025 Linda Ramey, Irs form 8889, health savings accounts (hsas), is used by taxpayers to report contributions to their hsa, claim deductions, and report distributions made from the account.

IRS Form 8889 ≡ Fill Out Printable PDF Forms Online, 41 OFF, Put simply, the irs uses form 8889 for hsa reporting.

IRS Form 8889. Health Savings Accounts Forms Docs 2023, Form 8889 is an irs tax form used to report contributions to and distributions from health savings accounts (hsas).

IRS Form 8802 Instructions U.S. Residency Certification Application, [1] this form is important for taxpayers who have made.

Almire KarolinaTessa ClariceLelah StCarmel Julienne